Here's a look back at some of the most impactful stories to end 2025. It’s a bit longer than usual, but hopefully worth the time investment. Thanks for reading.

-Brandon

In late 2025, the American economy faced profound shifts across all layers, from commodity markets to policy decisions. This special retrospective examines some of the year's biggest stories through the lens of our four-layer framework, showing how forces in one layer cascade through others.

Let's map the stories through the Four Economic Layers—so you can see what's actually driving costs upstream and where you have some real ability to influence your finances.

Data Snapshot

Here are two critical trend lines from federal sources:

Unemployment Rate Rising

The 1.1 million layoff threshold is confirmed by unemployment data. The rate climbed from 3.5% in early 2023 to 4.2% by late 2024—the highest point since the pandemic recovery began.

Source: Federal Reserve Economic Data (FRED) | U.S. Bureau of Labor Statistics

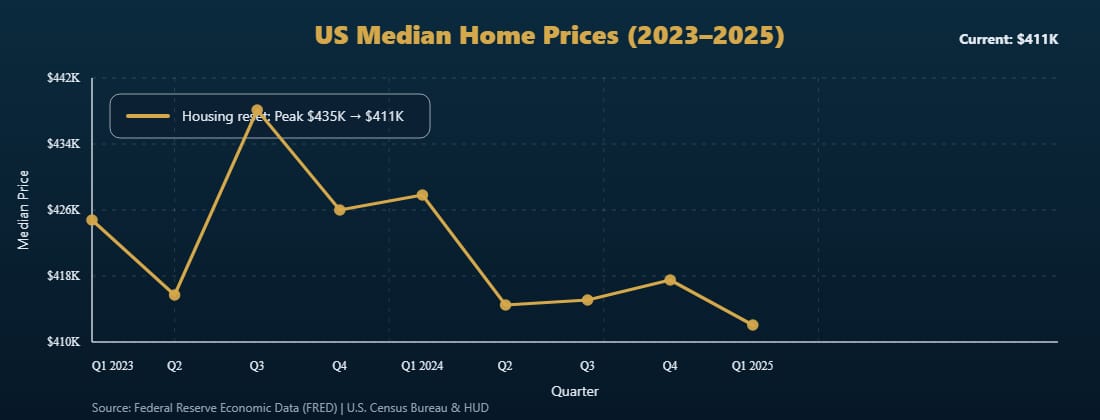

Housing Prices Retreating

The "Housing Reset" forecast is grounded in observable price trends. Median US home prices peaked at $435,400 in Q3 2023 but have declined 5.6%, to around $410,800 by Q1 2025—pointing to a market correction.

Source: Federal Reserve Economic Data (FRED) | U.S. Census Bureau & HUD

Stories from 2025’s End Across the Four Layers

Here's how costs and incentives flow from upstream → downstream → your monthly budget.

L1 - Natural Resources What comes from the earth?

Oil Prices Reach Four-Year Lows

Oil prices fell to ~$70/barrel in December 2025, the lowest since 2021. This was driven by increased global production and weaker-than-expected demand forecasts.[EIA, December 2025]

What this means for you: Gas prices drop, making your commute and shipping cheaper. Trucks carry goods more cheaply, which could lower prices at stores—though retailers don't always pass savings along.

💡 Opportunities

Margin relief for manufacturers: Lower feedstock costs give factories breathing room. Trucking companies can upgrade fleets at lower operating costs.

⚠️ Risks to Watch

OPEC production cuts: If major oil producers restrict supply, prices could rise to $80-85/barrel in Q2-Q3 2026, reversing this advantage. A geopolitical shock could spike prices higher. This relief is not guaranteed to persist.

Gold and Silver Smash Record Highs

Gold reached $4,500/oz and silver crossed $77/oz in 2025, marking multi-year highs. Investors sought these metals as a hedge against inflation and currency concerns.[COMEX, December 2025]

What this means for you: If you own gold jewelry or coins, they're worth more. Mining jobs in Nevada and Montana are expanding. However, this price spike reflects fear in the economy—it doesn't mean everything is fine.

💡 Opportunities

Mining expansion: High prices justify new mining projects in Nevada, Alaska, and Montana. Job creation accelerates in extraction and processing. Silver demand from solar manufacturing adds tailwind.

⚠️ Risks to Watch

Speculative bubble risk: Gold is vulnerable to a 15-20% pullback if investor fear subsides or bond yields rise. Mining projects built on current prices could become uneconomical if metals fall. A rapid correction is historically common after rallies of this scale.

L2 - Manufacturing & Construction What do we make from it?

Construction Starts Tumble 20.5%

Construction starts fell 20.5% in 2025, driven primarily by a retreat in megaprojects. This is a pullback from the post-pandemic boom, signaling tighter capital availability for large developments.[U.S. Census Bureau, December 2025]

What this means for you: Fewer new buildings and homes being started now means fewer will be available 2-3 years from now. Housing stays expensive. Construction workers face fewer jobs in the near term, but trade wages may rise as labor becomes scarcer.

💡 Opportunities

Wage growth in trades: Labor shortages for skilled construction workers strengthen wage bargaining power in 2026. Existing construction crews see better terms. Cost inflation in materials eases as demand softens.

⚠️ Risks to Watch

Housing shortage compounds: A 20% pullback worsens existing housing shortages. Without new supply, prices stay elevated. If federal infrastructure funding underperforms, the pullback extends, keeping residential real estate unaffordable for most workers.

Ford Pivots on EV Strategy with $6.5B Cancellation

Ford cancelled a $6.5 billion battery supply contract with LG Energy Solution, citing slower-than-expected EV adoption. This reflects a broader recalibration across Detroit as automakers reset production schedules.[Ford Motor Co., August 2025]

What this means for you: If you're waiting for affordable EVs, prices may not drop as quickly as hoped—fewer models coming to market. Mining jobs for lithium and cobalt in Nevada and Montana face pressure. Gas-powered cars stay relevant longer.

💡 Opportunities

Domestic battery manufacturing: Ford's pullback creates openings for American battery makers to capture share. EV pricing aligns more closely with consumer budgets, unlocking demand.

⚠️ Risks to Watch

Mining jobs and stranded capacity: Lithium mining projects built for aggressive EV timelines face scaling back or closures. Battery plants in the Midwest face layoffs. Chinese EV makers with cheaper batteries gain North American market share.

L3 - Retail, Services & Distribution How does it reach you?

Retail Giants Hit with Price-Fixing Allegations

PepsiCo and Walmart faced a class-action lawsuit alleging coordinated price-fixing over decades. The suit claims collusion on pricing for name-brand consumer products sold at retail.[Federal Court Filings, 2025]

What this means for you: Grocery prices have felt sticky (not dropping as fast as wholesale costs fell). If retailers lose, you might see rebates or price cuts. But lawsuits take years—don't expect relief immediately.

💡 Opportunities

Price reductions if settlements materialize: Antitrust wins force price adjustments or rebates, boosting household purchasing power. Smaller retailers and private-label brands gain shelf share as consumers seek cheaper alternatives.

⚠️ Risks to Watch

Litigation drag and cost pass-through: Lengthy legal battles may lead retailers to raise prices preemptively to cover legal costs. Settlements could consolidate market power further, reducing competition long-term. Small suppliers face tighter terms.

The Logistics Rebound: A Record Peak Season for Trucking

The trucking industry posted its best peak retail season in years. Carriers saw strong rates and steady volume throughout Q4 2025, driven by sustained consumer spending and efficient distribution networks.[American Trucking Associations, December 2025]

What this means for you: Truck drivers see better wages and job security. Delivery of packages and goods remains smooth. This is a leading indicator that consumers are still spending despite job cuts elsewhere.

💡 Opportunities

Driver wages and fleet modernization: Strong rates let carriers replace aging trucks with fuel-efficient models. Truck driver wages rise, easing labor shortages. Independent trucking companies strengthen against mega-carriers.

⚠️ Risks to Watch

Demand cliff from consumer spending slowdown: Trucking depends on consumer shopping. If layoffs accelerate or household debt pressures spike in 2026, freight demand could collapse quickly. Carriers who over-expanded face unprofitable routes and layoffs. Fuel price spikes erase thin margins.

L4 - Management & Politics Who sets the terms?

The 1.1 Million Layoff Threshold

U.S. layoffs surpassed 1.1 million in 2025, the highest since 2020. Major tech, finance, and manufacturing firms announced waves of cuts.[BLS Employment Situation, December 2025]

Forecast: Job market tightens through 2026. Unemployment likely rises from 4.2% toward 5%+, reducing consumer spending and creating wage pressure in low-skill service sectors.

What this means for you: If you work in tech, finance, manufacturing, or retail—job security feels shaky. Less money in workers' pockets means fewer customers for restaurants and stores. Your paycheck may not stretch as far if inflation continues.

💡 Opportunities

Wage negotiation power returns: As unemployment rises, workers laid off from high-paying roles may accept positions in other sectors, adding talent to the market. Companies face retention pressure and may offer better terms to keep experienced staff.

⚠️ Risks to Watch

Demand destruction feedback loop: 1.1 million laid-off workers reduce spending on retail, restaurants, and services. Declining sales force more layoffs. Long-term unemployment could permanently reduce labor force participation. Wage pressure accelerates automation adoption.

The Forecasted "Housing Reset"

Median home prices peaked at $435,400 in Q3 2023 and fell 5.6% to ~$410,800 by Q1 2025. Mortgage rates held near 7%, constraining affordability.[FRED, U.S. Census Bureau, Q1 2025]

Forecast: Economists forecast continued housing reset through 2026. Prices may fall another 5-10%, bringing median prices toward $380-395K range. This correction is driven by elevated interest rates and construction pullback.

What this means for you: If you're renting, homes may finally become more affordable—but only if interest rates drop. If you own, your home value may decline, but your mortgage payment stays the same. Construction jobs disappear temporarily before new projects start.

💡 Opportunities

First-time buyer entry points: A 5-10% price correction unlocks access for buyers priced out in 2024-2025. If rates drop even 1%, affordability improves significantly. Construction workers eventually rehire as new projects align with sustainable economics.

⚠️ Risks to Watch

Negative equity and defaults: A sharp correction traps homeowners underwater. HELOC borrowing collapses, starving small businesses of credit. Regional economies dependent on real estate (Arizona, Florida, Nevada) face distress. Financial institutions exposed to mortgage risk face losses. Construction unemployment rises before recovery takes hold.

The Health Insurance Affordability Crisis

Health insurance premiums climbed through 2025, with family plans now averaging $1,500-2,000/month. The gap between premium costs and household budgets widened, prompting emergency guidance from AARP and other organizations.[Kaiser Family Foundation, December 2025]

Forecast: Without policy intervention, premiums will continue rising 5-7% annually, pricing out millions from adequate coverage by 2027. Political momentum for reform will grow, but solutions take time.

What this means for you: Health insurance costs eat into your ability to pay for rent, groceries, and transport. Many workers skip coverage entirely and risk bankruptcy if they get sick. Doctors face more uninsured patients, straining emergency rooms.

💡 Opportunities

Policy reform and alt models: Political pressure creates openings for price controls, public options, or transparency mandates. Direct primary care, health sharing ministries, and telemedicine scale as affordable alternatives. Workplace wellness programs innovate to reduce costs.

⚠️ Risks to Watch

Medical debt and system fragmentation: Millions face impossible choices between premiums and essentials. Medical debt accelerates personal bankruptcies. Uninsured people skip preventive care, worsening health and overwhelming emergency rooms. System fragmentation accelerates if the healthy opt out, leaving only sick pools paying ever-higher rates.

Key Signals to Watch

For Investors: Sector Watch & 2026 Signals

Precious metals had a breakout year (gold +25-30%, silver +30%+) but face bubble risk. A 15-20% pullback is historically common after rallies this steep. Exit signals: Fed rate cuts, subsiding geopolitical tensions, or bond yields rising above 4.5%.

📊 Watchlist for 2026

Sector | Leading Indicator | Opportunity Window |

|---|---|---|

Mining / Materials | Gold/silver volatility; OPEC production cuts | Buy dips on geopolitical calms; short rallies |

Logistics / Trucking | Consumer spending, freight rates, fuel prices | Strong Q1-Q2; watch for summer slowdown if rates spike |

Housing / Real Estate | Mortgage rates, construction starts, home prices | Builders undervalued if reset is orderly (5-10%) |

Energy | WTI oil, OPEC announcements, geopolitics | Refiners profit from low crude; producers pressure mid-year |

Healthcare Tech | Insurance reform bills, telemedicine adoption | Direct primary care and digital health disruptors rise |

Housing entry points emerge: If median prices reach $380-395K and rates fall to 6.5%, first-time buyers and value investors may see positive risk/reward for the first time since 2022.

For Entrepreneurs: The Opportunity Map

The 2025 year-end data reveals three high-conviction opportunity zones for 2026. Each reflects real, observable pain in the economy:

1. Healthcare Cost Avoidance

The Pain: Insurance premiums averaging $1,500-2,000/month for families. Millions skipping coverage or preventive care.

Opportunity: Direct primary care platforms, telemedicine for chronic disease, health sharing ministries, or wellness tech that reduces insurance dependency. Watch for: Insurance reform timelines; state-level policy shifts; employer health program innovations.

Signals: If 3+ health tech IPOs happen in 2026 or state-level public option pilots launch, the market is validating the shift.

2. Affordable Housing Production

The Pain: Construction starts fell 20.5%, but demand remains. Housing prices stay high; renters priced out of ownership.

Opportunity: Modular/prefab housing startups, property tech for construction cost reduction, land development around transit, or software to streamline permitting. Watch for: State zoning reform, construction cost data, new housing unit completions.

Signals: If construction starts rebound 8%+ and housing prices stabilize, the reset cycle is complete and the next cycle begins.

3. Supply Chain Resilience

The Pain: Logistics strong, but vulnerable to fuel shocks and demand swings. Trucking faces driver shortages and margin pressure.

Opportunity: Logistics software for route optimization, last-mile delivery solutions (micro-fulfillment), or driver retention tech. Watch for: Fuel prices, driver wages, e-commerce growth.

Signals: If oil spikes to $80+ and logistics margins compress, automation solutions become urgent. If consumer spending slows, demand-forecasting tech becomes critical.

Cross-cutting pattern: Across all three opportunities, the common thread is cost reduction or efficiency gain in a system under stress. Companies that solve healthcare premiums, housing affordability, or logistics friction will attract capital and talent in 2026.

2026 will reward those who pay attention to the chains of causation, not just the headlines. Use this year-end snapshot as your baseline. Track the signals outlined above. And if you see something in your own work or wallet that confirms or contradicts what was laid out, let me know—that's how we all learn and grow together.

If this framework helped you make sense of 2025 and prepare for 2026, send this to someone who wants to spend smarter, invest better, or build on emerging opportunity.

Subscribe to Coalscoop for weekly deep-dives on the stories that matter—delivered with the same rigor and accessibility you've seen here. I aim to publish weekly with fresh reporting, data, and practical signals you can act on.

Thank you for spending time here. I’m grateful for your attention, your feedback, and your trust. Here's to a clear-eyed 2026!

-Brandon

** Disclaimer **

Coalscoop is published by Firesteel Studios, LLC for informational and educational purposes only. I'm not a licensed financial advisor, investment professional, or attorney, and nothing here constitutes financial, investment, legal, or professional advice. By reading Coalscoop, you acknowledge that you're solely responsible for your own decisions and will not hold Coalscoop or Firesteel Studios, LLC liable for any losses or consequences arising from the use of this information.