This Week's Big Story

A 50-year mortgage sounds like relief: a smaller monthly payment in a world where housing costs feel untouchable. But there's a hidden trade-off, trading a modest monthly cushion today for hundreds of thousands of dollars in additional interest over the life of the loan.

The good news? Policymakers are finally talking about the monthly payment problem. The catch? Extending the loan term is a weak lever compared to what actually moves the needle: lower interest rates and more housing supply.

Key insight: A longer mortgage doesn't make housing affordable; it just spreads the same problem across more months.

The question isn't whether a 50-year option exists; it's whether you should use it, and more importantly, what the real levers are for getting ahead of this cost.

The Rule of Thumb

If you need 50 years to afford the monthly payment, the house is probably too expensive for your budget. Focus on what you can control: rates, down payment size, and buying within today's constraints—not tomorrow's policy hopes.

Let's map the story through the Four Economic Layers—so you can see what's actually driving costs upstream and where you have real leverage.

Data Snapshot

30-year mortgage rate: 6.2% (as of Dec 31, 2025)

1-year rate change: -0.7 percentage points (moving in the right direction!)

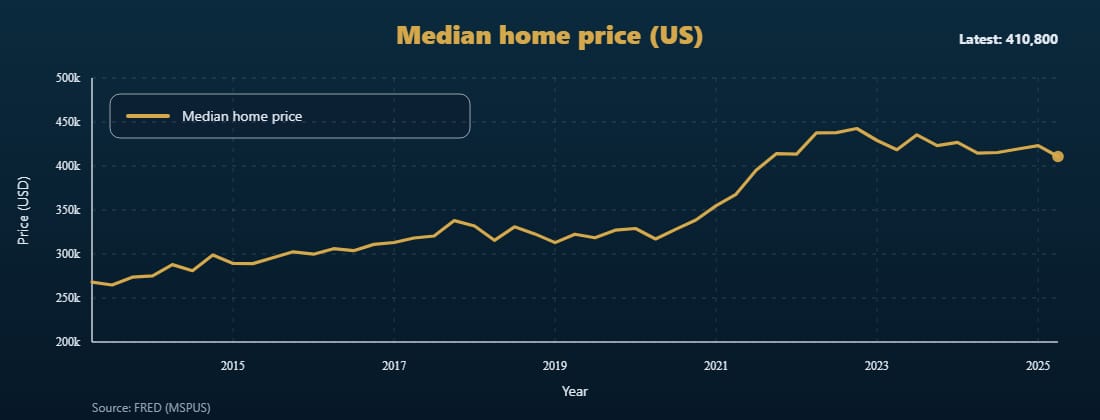

Median home price: $410,800 (April 2025)

The lifetime cost trade-off (principal + interest only): A median-priced home ($410,800) with 20% down means a ~$328,640 loan. At a 6.2% rate:

30-year mortgage: ~$2,013/month; total interest paid: ~$396,000

50-year mortgage: ~$1,779/month; total interest paid: ~$739,000

Monthly savings: ~$234/month

Total extra cost: ~$343,000 more in interest (that's the real price)

On the 50-year option, the monthly payment looks better. The lifetime bill? Dramatically worse, assuming you keep the same rate and make only the required payment. In real life, many borrowers refinance, move, or prepay—but longer terms keep principal outstanding longer, so equity builds more slowly unless you refinance into a shorter term and/or pay extra principal.

Why "Easier Credit" Can Actually Raise Prices (Not Lower Them)

When lenders expand who can qualify (with longer terms or lower down payments), buyer demand increases. But if available homes don't increase at the same pace, prices rise, and you’ll pay more for the same house. This is why more housing supply is the real affordability lever—it's the only way to break this cycle.

The Four Layers

Here's how costs and incentives flow from upstream → downstream → your monthly budget:

L1: Natural Resources

The issue: Land, materials, energy, and labor set the floor for construction costs. When supply is tight, these costs cascade forward.

What's happening now: A 50-year mortgage doesn't lower physical costs; it stretches the payment timeline and increases demand pressure in a constrained market.

What you can do:

Watch housing starts and building permits—they signal when new supply might ease prices. However, this might also indicate more demand for raw materials.

If renovating or building, get multiple bids early to stay ahead of increasing demand, as costs can lag material price moves by months.

L2: Manufacturing & Construction

The issue: Builders and contractors are the gatekeepers of supply. More building eases housing prices; under-building periods create multi-year shortages that financing tweaks alone can't fix.

What's happening now: If a 50-year mortgage expands qualification without increasing supply, bids stay high. The monthly payment improves for you, but the total price climbs—and sellers/builders capture the benefit.

What you can do:

If buying, favor markets with visible construction pipelines and higher home turnover.

If renting, track new housing deliveries—your negotiation leverage rises when vacancies rise.

L3: Retail, Services & Distribution

The issue: Lenders, agents, and insurers mediate homeownership. Small rate changes swing affordability more than small price changes; your monthly payment is the binding constraint.

What's happening now: Longer-term loans may expand who qualifies, but they keep bids high unless supply increases. Real gains come from lower rates, not longer terms.

What you can do:

Shop at least 3 lenders and negotiate: rate buydowns, closing cost waivers, or principal reductions.

Model your true monthly cost: principal + interest + property taxes + insurance + HOA + 1% maintenance buffer.

Keep debt-to-income below 43% to preserve liquidity as your safety valve.

If a 50-year option appears, use it only as a last-resort bridge to a more affordable home, never to stretch for a bigger purchase.

L4: Management & Politics

The issue: The Federal Reserve, HUD, and Fannie Mae/Freddie Mac (the GSEs that guarantee most mortgages) set credit rules. Expanding credit without increasing supply often raises prices as much as it raises access.

What's happening now: The HUD Secretary's "more research" signal is caution. Details matter: eligibility, fees, and prepayment terms shape real impact more than the headline term length.

What you can do:

Watch program details: eligibility, fees, and prepayment rules matter most.

Track mortgage rates weekly and set "refinance triggers" (if rates drop 0.5%+ and you’re ready to move otherwise, call your lender).

Don't rely on future policy to rescue a stretched purchase; buy within today's constraints.

Key Signals to Watch

These metrics show whether affordability is improving or deteriorating:

Mortgage rates (30-year fixed): Direction matters most. Every 0.5% move materially changes affordability; rates in the mid-5s (or lower) are meaningfully easier than today.

Housing starts & building permits: More supply = eventual price relief. Rising numbers are a green light; flat or falling are a warning.

Inventory & months of supply: Historically, ~6 months is "balanced." Below that tends to favor sellers; above that tends to favor buyers. Track your local market.

New housing deliveries (rentals & for-sale): If more units come online than are absorbed, vacancy rises and rents soften.

Where to Look for Advantage (If You're Thinking Strategically)

L1 & L2: Housing starts, permits, and local zoning changes are leading indicators. Markets opening to ADUs or streamlining approvals often see supply relief first.

L3: Refinancing and rate-shopping services become valuable as rates move. Lender rate variations often exceed what borrowers discover.

L4: GSE policy, local zoning reform, and supply-side advocacy gain traction when affordability crisis is top-of-mind.

A Note for Renters

Mortgage policy can spill over into rents. If easier credit props up home prices without unlocking much new supply, more households can end up renting longer—keeping rental demand firm. The counterweight is new apartment supply: when deliveries outpace demand, vacancy rises and rents soften. Monitor local vacancy and new multifamily deliveries, and don't rush into ownership just because a 50-year mortgage exists.

Bottom Line

A 50-year mortgage is a tool, not a solution. It can ease near-term payment pressure, but at the cost of decades more interest (potentially $300K+). More importantly, it doesn't address what actually moves affordability: lower rates (which are starting to move in the right direction) and more housing supply (which is still constrained). If you're house hunting, focus on what you can control: shop rates aggressively, understand your full monthly burn, keep debt-to-income conservative, and buy within today's constraints. If you're renting or investing, watch the supply signals—they're the real story.

Thanks for reading all the way to the bottom! If you think others would find value in receiving this newsletter, please forward. And if you’re someone who received this from a friend and would like to subscribe, do so at coalscoop.com.

-Brandon

Sources:

Data

FRED: MORTGAGE30US (30-year fixed mortgage rates)

FRED: MSPUS (Median home price)

FRED: HOUST (Housing starts)

FRED: PERMIT (Building permits)

Reading

** Disclaimer **

Coalscoop is published by Firesteel Studios, LLC for informational and educational purposes only. I'm not a licensed financial advisor, investment professional, or attorney, and nothing here constitutes financial, investment, legal, or professional advice. By reading Coalscoop, you acknowledge that you're solely responsible for your own decisions and will not hold Coalscoop or Firesteel Studios, LLC liable for any losses or consequences arising from the use of this information.